We are currently experiencing a shift similar to when digital spreadsheets replaced traditional bookkeeping in physical ledgers. Automated accounting software is becoming the new standard, replacing manual data entry and spreadsheet calculations.

Small businesses benefit from accounting software, saving time and increasing productivity while detecting errors.

This blog explains the top 10 software to help you automate your accounting and bookkeeping process.

10 Automated Bookkeeping Software You Should Know

Here’s a quick list of the top 10 software for accountants today.

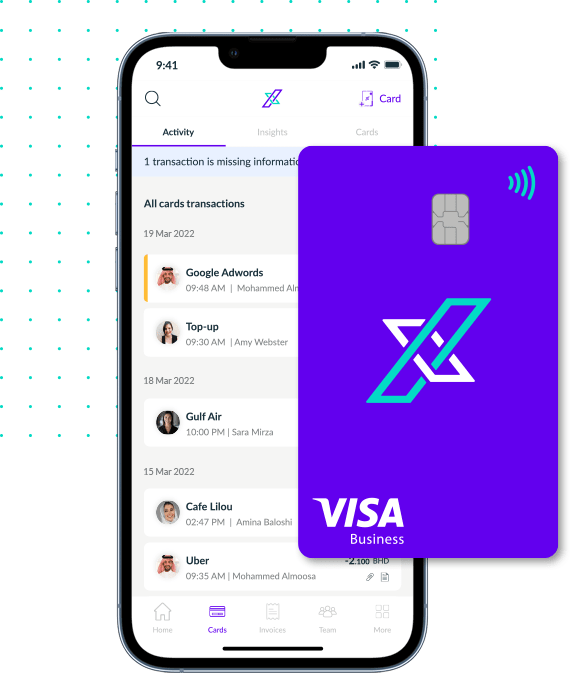

Xpence

Xpence is by far the most easy-to-use, user-friendly tool for automated bookkeeping on this list. It can capture, digitise, and automatically categorise transaction receipts with a simple scan.

Its auto-categorisation capabilities have helped business owners save valuable time when tallying their expenses at the end of the month. It also provides rich insights into where your money is going and areas to cut back on.

After its user-friendliness, Xpence’s second most excellent standout feature is how far it goes to foolproof your bookkeeping without burdening you. It sends reminders to capture a picture of your receipt every time you pay, so you never lose any records.

Xpence keeps expanding its integration ecosystem to more and more accounting tools and payment service providers, allowing its users to export their data quickly, no matter where they’re based. To get started, you only need to open an Xpence account.

Best-suited for: All business types of all sizes and Industries looking for a budget-friendly plan.

| Unique Features | Pros | Cons |

|

|

|

QuickBooks

Small businesses, self-employed individuals, and freelancers widely use QuickBooks due to its user-friendly interface and pricing options.

It also integrates natively with most payment services like PayPal and Stripe, so the records appear automatically when you send or receive payments in QuickBooks.

Best-suited for: Small businesses, Startups, and self-employed individuals looking for budget-friendly plans.

| Unique Features | Pros | Cons |

|

|

|

Xero

Xero is an award-winning cloud-based accounting software known for its ease of use and advanced automation capabilities. Because it’s cloud-based, it’s accessible from anywhere, making it ideal for businesses with remote teams in varying locations.

Xero has become one of the most popular accounting tools for businesses with international operations because of its multi-currency support, allowing easy management of foreign transactions.

Best-suited For: SSmall businesses, Startups, and self-employed individuals looking for budget-friendly plans.

| Unique Features | Pros | Cons |

|

|

|

Sage Intacct

Sage Intacct is an accounting software tailored for businesses with advanced financial management requirements.

While not the cheapest, Sage intact comes with incredibly sophisticated reporting and analytics tools, making it ideal for medium-sized enterprises that require data-driven insights for strategic decision-making.

It also offers dimensional accounting to track transactions made by various dimensions such as department, location, or managerial level, allowing you to create all kinds of reports.

It is best suited for Medium-sized businesses with flexible budgets.

| Unique Features | Pros | Cons |

|

|

|

FreshBooks

Like Xero and QuickBooks, FreshBooks is also a cloud-based software for accountants and is tailored specifically for businesses offering a service. Freshbooks includes time tracking, automated invoice reminders, and many other project management features that make it ideal for companies that bill clients based on hours worked.

It’s also known for having an aesthetically pleasing user interface and being easy to use for non-accounting professionals.

Best-suited for: Large service-oriented or creative businesses looking for budget-friendly plans.

| Unique Features | Pros | Cons |

|

|

|

Plooto

Plooto is a payment automation platform designed to simplify and streamline account management and payment processes for businesses of all sizes. It’s cloud-based and offers automated bill management, multiple payment methods, and multi-currency support, making it ideal for companies with remote teams.

Plooto’s accounts payable automation sets it apart, which is particularly beneficial for businesses focusing on cash flow and timely payments.

Best-suited for: Businesses of all sizes looking for a budget-friendly plan.

| Unique Features | Pros | Cons |

|

|

|

NetSuite

NetSuite is a comprehensive ERP system that offers advanced automation and financial management with extensive customisation options to tailor your experience according to industry-specific standards and your unique needs. It’s known for its powerful e-commerce integration that allows businesses to manage online sales channels and inventory.

In addition to its library of customisation options, NetSuite is adaptable to all countries and industries as it supports multiple languages, currencies, tax regulations, and compliance requirements.

It’s on the pricier side of all the other entries on this list, but it might be your ideal choice if you have the budget and need an all-in-one solution.

Best-suited for: Large Businesses with advanced needs and a high budget.

| Unique Features | Pros | Cons |

|

|

|

Wave Accounting

Wave Accounting is a free-of-cost software for accountants that offers automated invoicing, receipt scanning, and financial report generation. The core features are free, but add-ons like mobile receipts, payroll, bookkeeping support, and expert consultations cost an additional price. One of its most unique features is the receipt scanning app that allows users to digitise paper receipts for expense tracking.

Wave integrates with your bank accounts so that you can automate the bank reconciliation process. It also offers multi-currency support and integration with third-party payment processors to extend functionality. It’s an excellent option for small business owners or freelancers at the start of their journey.

Best-suited for: Small businesses, Startups, and self-employed individuals looking for budget-friendly plans.

| Unique Features | Pros | Cons |

|

|

|

Oracle Financial Services Accounting Hub

Oracle Financial Services Accounting Hub is an intensively designed software solution for businesses with highly complex financial requirements. Oracle’s solution excels in managing complicated compliance requirements for heavily regulated industries such as Insurance, Banks, and Asset Management firms. It helps ensure compliance with accounting standards like IFRS and GAAP.

Oracle’s advanced accounting logic can also handle various financial products and transactions, including loans, deposits, securities, derivatives, etc. It serves as a centralised repository for financial data by consolidating and unifying data from different economic systems.

The only major drawback to Oracle’s Financial Services Accounting Hub is the price.

Best-suited for: Large organisations with a substantial budget, complex financial requirements, and heavy regulatory oversight.

| Unique Features | Pros | Cons |

|

|

|

Kashoo

Kashoo is a cloud-based accounting and bookkeeping software designed primarily for small businesses, freelancers, or sole proprietors planning to scale. It has one of the most user-friendly interfaces of the other entries on this list and uses simplified accounting tools to cater to users who may not have a strong background in accounting. Kashoo’s standout feature is that it offers tutorials and resources to help users enhance their accounting knowledge.

Kashoo uses double-entry accounting principles that help maintain accurate financial records by recording the debits and credits for each transaction. It also offers automated invoicing, bank reconciliation, and financial reports.

It is best suited for small businesses, startups, and self-employed individuals with a flexible budget.

| Unique Features | Pros | Cons |

|

|

|

Final Thoughts

Automated accounting software offers a multitude of benefits to organisations of all sizes. By taking care of repetitive tasks, not only do they save time and enhance productivity, but they also prevent errors. By embracing these tools, businesses can take a significant step towards efficiency, precision, and future-proof financial management.