Financial planning and analysis (FP&A) has often been touted as the backbone of a successful business plan. Every stage of business, from launch to expansion and even closure, requires a financial guide at the helm to save the industry from bankruptcy, incurring excess debt, and legal complications.

Technology integration with commerce, trade, and finance has made many aspects of financial management convoluted, some even needing to be updated. The essence and fundamentals of solid FP&A are waning.

This blog explains the key components of FP&A, common financial planning challenges, and how to leverage the technology to overcome these challenges.

What is Financial Planning and Analysis (FP&A)?

Financial Planning and Analysis is a series of steps and analytical activities that support a company’s major decisions by mitigating risks and protecting the business’s overall financial health.

It involves budgeting, forecasting, and creating financial models or plans to support the business in all foreseeable scenarios.

A skilled finance team uses a wide range of knowledge and abilities, such as logic, strategy, math, statistics, and technology, to tackle complex financial challenges and find opportunities for business success in both the short and long term.

They do so while trying to ensure that the balance of risk and reward remains healthy and that the business has enough fallbacks for foreseen and unforeseen eventualities.

Key Components of FP&A

A finance team’s role is to employ the following skills and tools to derive actionable insights for the board of directors and executive team.

Budgeting

Budgeting involves estimating or calculating the funds a company will require to execute a business plan by allocating a budget to each department or function. Financial controllers and analysts must also consider the revenue and cash flow expected from the upcoming periods while preparing the budget.

Budgeting helps organisations set financial expectations, allocate resources efficiently, and monitor their performance against planned targets.

Forecasting

Forecasting involves studying historical financial data, market conditions, trends, and business strategies to make informed projections about the organisation’s future revenue, expenses, and other financial metrics.

Forecasting is typically limited to shorter time frames than budgeting because the distant future is almost impossible for even seasoned financial analysts to predict.

As a forecaster, your job is to analyse data and identify emerging trends and other relevant information in real-time. This task is typically time-sensitive and requires accuracy to maintain a stable cash flow, identify potential risks and opportunities, and ensure the company can adapt to changing market dynamics.

Variance Analysis

Variance Analysis is the process of comparing plans with results. It involves comparing actual financial results to the budget and forecast to identify discrepancies.

Variance Analysis helps organisations understand how they might have deviated from their expected outcomes and bounce back with a more robust, more actionable business plan. Businesses can only identify discrepancies and take corrective actions with Variance Analysis.

Financial Modeling

Financial modelling uses technology and software to create well-structured representations of the organisation’s forecasts and business performance. It provides the visual aids necessary to help finance teams communicate efficiently with the team of executives during strategy meetings.

Financial models range from simple to complex and can be used for various purposes, such as valuation, investment analysis, and business planning.

Scenario Planning

Scenario planning is an often skipped but massively underrated function of FP&A. It involves visualising or simulating multiple likely future scenarios to prepare for different outcomes. It helps organisations remain agile despite growing uncertainty and respond to challenges to conviction.

Multiple internal and external factors can impact the company’s future financial performance. Companies can develop contingency plans and strategies by analysing these factors and the scale of their impact.

Common Challenges of FP&A

Financial planning and analysis require tremendous foresight, attentiveness to detail, and a thorough understanding of the financial system and bookkeeping.

Some of the common challenges that make FP&A arduous and meticulous include:

Data Accuracy

- – Data Integrity: Ensuring accurate and consistent financial data is crucial for informed decisions.

- – Data Sources: FP&A professionals often need to consolidate data from various sources, which can be time-consuming and prone to errors.

- – Data Entry and Validation: Manual data entry and validation processes can introduce human errors into financial models.

Changing Business Conditions

- – Economic Volatility: The global economy is subject to constant fluctuations, making it challenging to predict future financial outcomes accurately.

- – Market Dynamics: Rapid market conditions, customer preferences, and competitive landscape changes can disrupt financial plans and forecasts.

- – Regulatory Changes: Evolving regulations, tax codes, and accounting standards can complicate financial reporting and compliance.

Communication

- – Silos: In some organisations, different departments may operate in isolation, which can impede the flow of information and collaboration necessary for effective FP&A.

- – Technical Jargon: FP&A professionals often use complex financial terminology, which can create a communication gap with non-financial stakeholders.

- – Timeliness: Delays in sharing financial information and insights can limit the agility of decision-making processes.

Automated Tools for Financial Planning and Analysis

Although technology has made finance management more complicated for the layperson, solutions for simplicity ironically also emerge from the same domain. Tools and technologies, when mastered, make financial management more effortless than it has ever been.

Financial Software

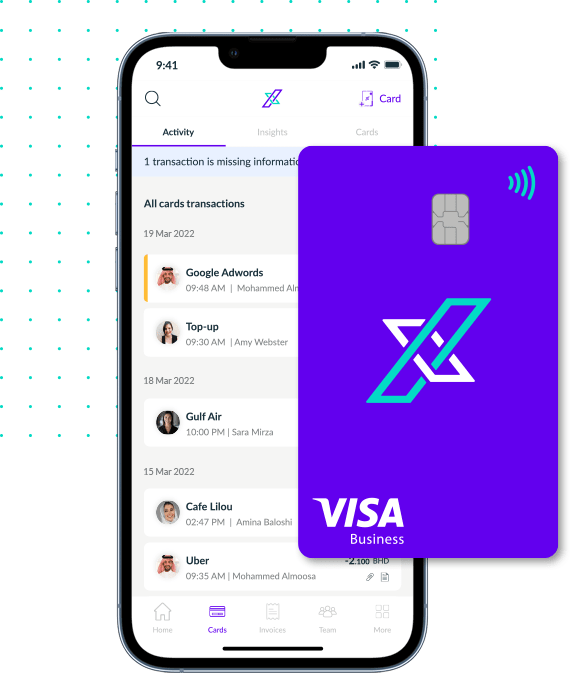

FP&A professionals rely heavily on advanced software to help them manage financial data, track and limit expenses for their team, and prepare budgets, forecasts, reports, and visual aids for scenario planning. These software help save time and improve efficiency.

Data Analytics And Reporting Tools

Data visualisation tools help FP&A professionals create compelling visual representations of financial data to help stakeholders better understand complex information. Data warehousing solutions like Snowflake and Amazon Redshift centralise data from various sources, making accessing and analysing large datasets easier.

Automated Bookkeeping

Automated Bookkeeping software eliminates the need for making manual entries, which can save businesses a lot of time and improve the accuracy of their records. They also allow businesses to generate and view real-time expense reports with advanced analytics to identify trends.

Final Thoughts

A well-coordinated and structured finance team is the cornerstone of any successful business enterprise. Financial Planning and Analysis have always been demanding, but we’re fortunate to live in a time with tools to make it easier. A lot of time tends to be lost in manual and repetitive tasks.

By leveraging technology and automation, financial analysts today can create more time for themselves to think about data analytics and ideate solutions.