According to World Bank data, credit card usage has surged globally, with over 74% of people employing these financial tools. They are pivotal in modern finance, offering convenience, cashless transactions, online shopping, and emergency funds. Canada leads with an 82.74% usage rate.

Credit cards also assist in building credit history and offer rewards for better financial management. The global credit card market reached USD 489.4 billion in 2021, poised for substantial growth, projected to hit USD 961.2 billion by 2030, with a 7.78% Compound Annual Growth Rate (CAGR) anticipated from 2023 to 2030.

What is Credit Card Reconciliation?

Credit card reconciliation is a systematic financial process that ensures accuracy between credit card statements and accounting records. It involves

- – Data Collection: This is the initial step in the credit card reconciliation process. It involves gathering all relevant financial documents, primarily credit card statements, and supporting receipts. These documents are essential for ensuring that all transactions are accurately accounted for.

- – Comparison: Once the data is collected, the next step is to compare each credit card transaction with corresponding entries in the company’s accounting records. This comparison is crucial to verify that all transactions on the credit card statement are accounted for in the company’s financial records. It helps identify any discrepancies or missing transactions.

- – Discrepancy Resolution: Discrepancy resolution is a critical phase of the reconciliation process. It involves investigating and resolving any inconsistencies or discrepancies during the comparison step. Discrepancies may include errors in transaction amounts, double entries, missing receipts, or unauthorized charges.

- – Record Updates: After resolving discrepancies, the reconciliation process requires accurately updating the company’s accounting records to reflect the reconciled data. This step ensures that the financial records accurately reflect the company’s financial position, accounting for all credit card transactions.

- – Payment Recording: Payment recording involves documenting credit card payments made by the company. This step ensures that credit card payments are properly recorded in the company’s financial records, reducing outstanding balances and ensuring accurate financial reporting.

- – Reporting: The final step of credit card reconciliation involves generating reports to analyze and document the reconciliation process. These reports provide a comprehensive overview of the reconciliation efforts, including details on any discrepancies found and how they were resolved. Reporting is essential for maintaining transparency and accountability in financial management.

This systematic approach guarantees financial accuracy, fraud detection, and sound expense management, making it a crucial practice for individuals and businesses. Automation tools enhance efficiency in this process.

Challenges and Solutions with Credit Card Reconciliation

Credit card reconciliation is vital for financial accuracy. It ensures tracking expenses, detecting errors, and preventing fraud. Moreover, it helps maintain a healthy credit score and budget management. This practice is necessary to avoid financial chaos and missed opportunities for savings and growth.

| Challenges | Solution |

| Transaction Discrepancies: Inaccurate transaction recording leads to discrepancies between records and statements. | Automation: Implement reconciliation software for real-time tracking and error reduction. |

| Late Reconciliation: Delays in reconciling credit card statements can result in missed payments or interest charges. | Receipt Management: Digitize receipts, use expense tracking apps, and encourage timely submission. |

| Missing Receipts: Difficulty in locating or obtaining receipts for certain expenses. | Set Deadlines: Establish regular reconciliation schedules and enforce timely reporting. |

| Employee Fraud: Unauthorized or fraudulent charges by employees can go unnoticed. | Internal Controls: Implement strict expense policies and conduct periodic audits to deter fraud. |

| Data Entry Errors: Manual data entry leads to typographical errors and misreporting. | Data Validation: Employ double-checks and validation protocols to minimize data entry errors. |

| Hidden Fees: Failure to notice and account for hidden fees on credit card statements. | Thorough Review: Scrutinize credit card statements for hidden fees and discrepancies during reconciliation. |

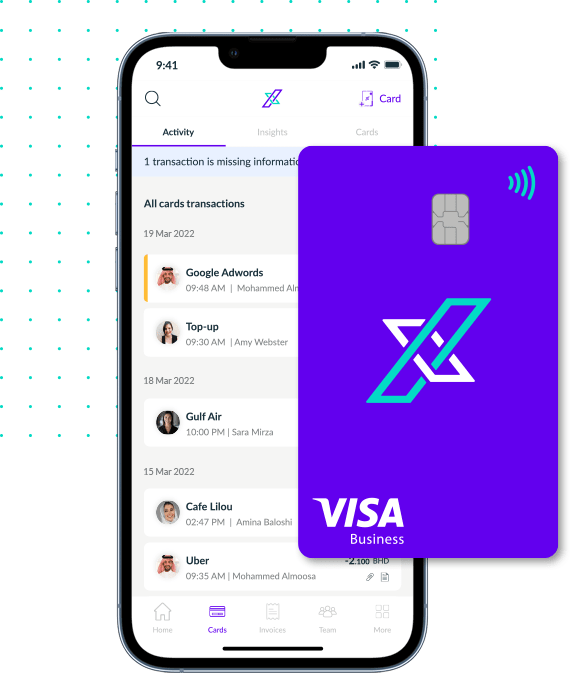

Automated Credit Card Reconciliation with Xpence

Xpence simplifies expense reconciliation with automated card management. With Xpence cards, you can reconcile them effortlessly without spending much time on it.

Xpence allows you to issue multiple cards to your employees with varying spending limits. With Xpence cards, you receive instant notifications regarding expenses. You can promptly approve or reject employee expenses, resulting in faster reimbursements and an improved employee experience.

4 Reasons Why You Should Switch to Automated Solutions

When it comes to credit card reconciliation, transitioning to an automated solution, like the virtual card we offer, can be a game-changer for businesses in the UAE. Here are compelling reasons to switch:

Real-time Card Statements for Instant Insights

Dealing with delayed credit card statements can frustrate and hinder effective financial management. Our virtual card solution offers a dashboard where all card spending is consolidated and updated, providing real-time access to transaction information whenever needed.

You can effortlessly track every payment, see who initiated and approved each transaction, identify the supplier, view attached receipts, and understand the reasoning behind each expenditure. The days of chasing down mysterious payments are a thing of the past.

Better Card Control

Having a shared company credit card can be problematic and pose a risk of fraud. When too many people have access to a single card, it becomes challenging to track who makes purchases. This lack of transparency can result in financial discrepancies and even security concerns.

Our virtual card solution offers a revolutionary approach. Each user is assigned an individual virtual card with personalized spending limits. This means that managers or the CFO can exercise precise control over expenses. Specific purchases can be approved or declined, and spending limits can be adjusted for individuals or teams.

With every payment logged in real-time, you always have a clear picture of who is spending within the defined limits. This level of control minimizes the risk of unauthorized or excessive spending, ensuring financial accountability within your organization.

Streamlined Receipt Management with Mobile Integration

Traditional credit card receipts can be a headache for bookkeepers, often arriving long after the transaction and being susceptible to loss or damage due to their paper format.

Our virtual card solution lets your team members access a mobile app that simplifies the receipt management process. At the point of purchase, users can effortlessly snap photos of their receipts, ensuring they can access these critical documents well before they can be misplaced or deteriorate.

Even better, if a team member needs to remember to capture a receipt, they can be promptly reminded via Slack, email, or the app. This proactive approach has resulted in an impressive 98% receipt collection rate for most users, making reconciliation smoother than ever.

Effortless Automated Reconciliation

Say goodbye to the era of paper-based finance processes. Our virtual card solution enables the submission of payment details and receipts in digital format, eliminating the need for time-consuming data entry tasks for your finance team.

The reconciliation process can be almost entirely automated. Spend management software takes care of itemizing and categorizing expenses, and a simple export sends this organized data to your accounting tools.

No more sifting through spreadsheets or comparing paper card statements to computer screens. Our software matches card payments against your ledger, highlights duplicates, and flags inconsistencies. The result? Days of manual work saved, and a streamlined, error-free reconciliation process.

Conclusion

In summary, credit card reconciliation is a vital financial practice that ensures accuracy and transparency in managing one’s finances. It involves aligning credit card statements with accounting records, resolving discrepancies, and maintaining financial integrity. Automated tools simplify this process, reducing errors and enhancing efficiency.

By diligently reconciling credit card transactions, you can track expenses, detect fraud, and make informed financial decisions, ultimately contributing to better financial health and management of your business.