Once your business has done the hard work delivering your products or services, it’s time to get paid. First, you’ll need to prepare your invoice to send to your customer or client and ensure it’s paid – without delay.

But with the different types of invoices and their varying purposes, the top priority is getting all invoices paid quickly.

Let’s find out more.

What is an invoice?

An invoice describes the services you provide or items you sell to a customer or client. It is a document that lists what payment is due from the customer and any Value-Added Tax (VAT) if it applies.

Tip: An invoice is crucial in bookkeeping and tax management filing because it serves as legal documentary evidence of the goods sold or services provided.

So, why do you need to issue an invoice? Ultimately, it’s to let customers know how much money they owe and give them the terms to pay you. It’s also to:

- – Easily track your sales transactions.

- – Get paid faster.

- – Help you keep accurate records for your bookkeeping.

- – Make sure you stay compliant, e.g. VAT laws in UAE mean you must send an invoice.

- – Ensure smoother tax filing when you need to do your returns at the end of the year.

Check Expense Management Solution For Freelancers.

Invoice types

Now you know why you’d send an invoice, let’s cover the different types of invoices:

Tax invoices

- – They’re commonly used if you live somewhere that requires you to issue tax invoices.

- – You’ll need to cover details, including the buyer’s name and address and their VAT number. Make sure you include your VAT number and rate and the VAT rate written in words and numbers.

- – Don’t forget to include a label that says ‘Tax invoice’ when you send it to your client.

Simplified Invoice

- – Simplified invoices contain minimal details of the purchase and don’t include the VAT amount.

- – They’re mainly used for Business to Consumer (B2C) transactions.

Proforma Invoice

- – These are usually estimated invoices sent to a buyer to request payment before delivering the goods or services.

- – By sending your estimate in advance, buyers can agree to the quoted price before you get to work.

Debit/Credit Note

- – Debit/credit notes are sent when there is an adjustment, cancellation, or change to an existing invoice.

- – For example, you have already issued an invoice worth AED 500 for ten items. However, if the buyer returns two items, you will have to issue a credit note, which they can use towards a future product or service.

Tip: Never cancel or delete an invoice; instead, use debit/credit notes. It will help you keep track of your sales and streamline your accounting.

Check More: Business Financial Planning Benefits

Paper or digital invoice?

When you’re faced with the option of sending a receipt digitization or manually, it’s best to think about what suits your business.

Typically, manual invoices will require more effort – you’ll need to fill them out each time.

Instead, suppose you decide on a digital invoice that’s generated by software or a programme. In that case, you can take the stress and repetition out of writing an invoice each time.

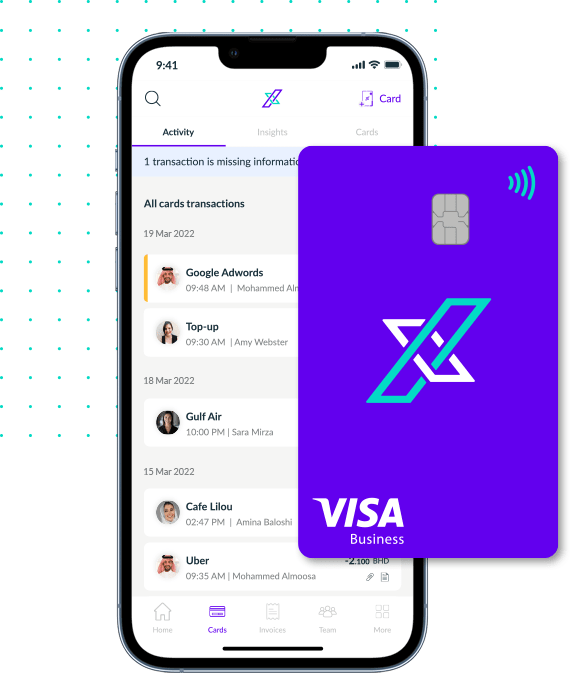

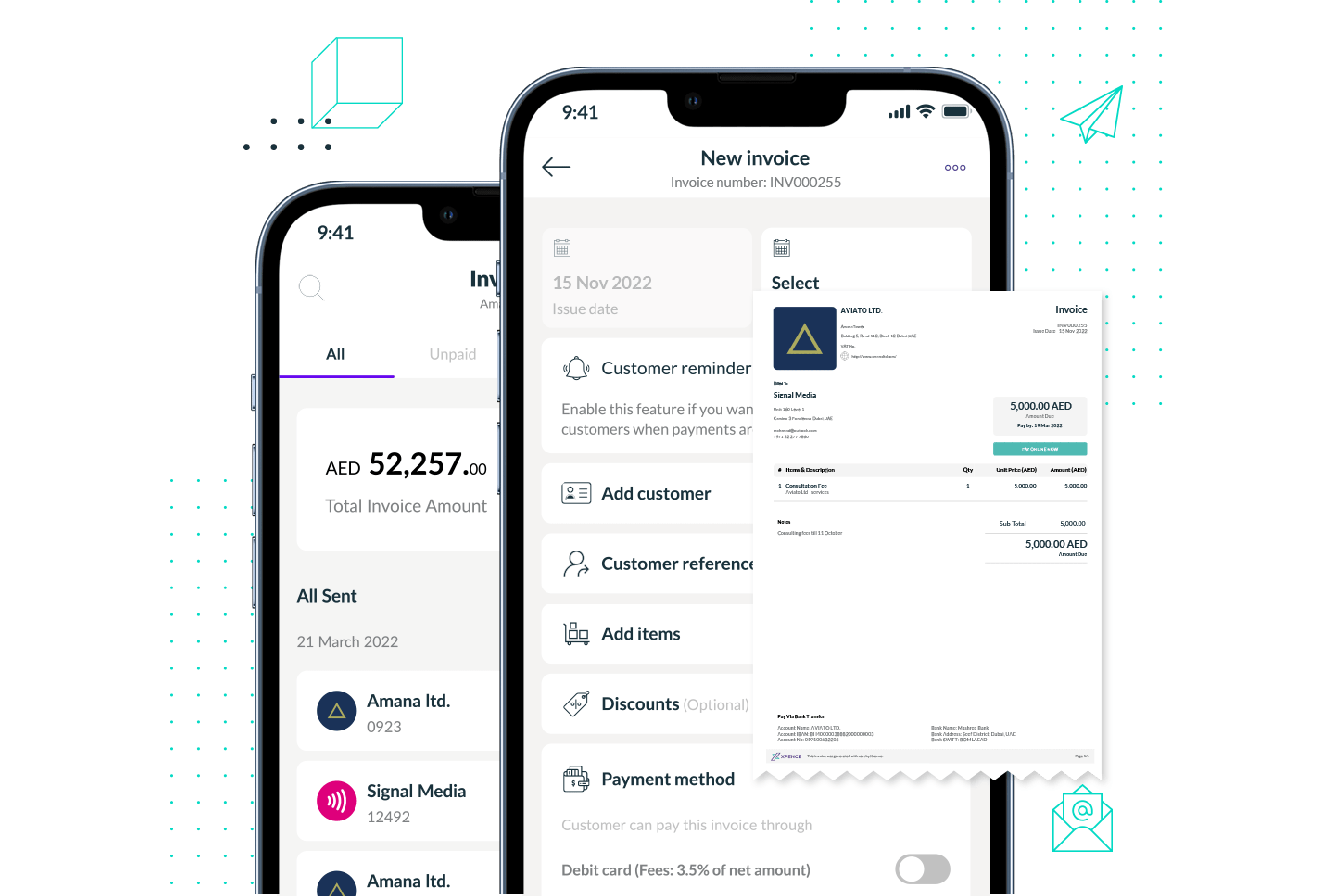

Xpence created an invoice generator to do the hard work for you.

Generate, track, chase, and report on your invoices in our easy-to-use smart software.

Check more about expense management Solutions for freelancers

Automate your invoices with Xpence

Xpence lets you streamline your billing so that you can record, generate, and store e-invoices:

- – Automated Invoicing: Issue invoices automatically. You must select the customer’s name and amount for the invoice you’re creating.

- – Smart Tracking: Send your invoice and sit back – Xpence will follow up with your customer and even send you reminders and notifications to keep you updated.

- – Easy Access: All invoices are stored on the cloud so that you can generate, modify, and send invoices anytime from anywhere.

- – Customized invoices: Use multiple invoicing formats depending on your client without the need to create them individually each time.

- – Secure payments: Get instant documentary proof of your work, which can help you get paid faster using various payment methods and more securely.

Choosing Xpence invoicing software gives you a one-stop-shop solution for multiple invoicing tasks.

Download the App and sign up Now to get your hands on experiencing the award-winning expenses management and invoicing platform.

Read more: How e-Receipt Management Help Businesses?